Accounting and Financial Services Program Description

Hocking College’s associate degree program is designed to provide students with the hands-on learning experience they’ll need to successfully enter the accounting industry.

Courtesy of Hocking College’s smaller class sizes, students will be able to get the crucial one-on-one time with their instructors they need to become proficient in cost accounting, Federal taxation & auditing, payroll accounting, MS Office software, and QuickBooks software.

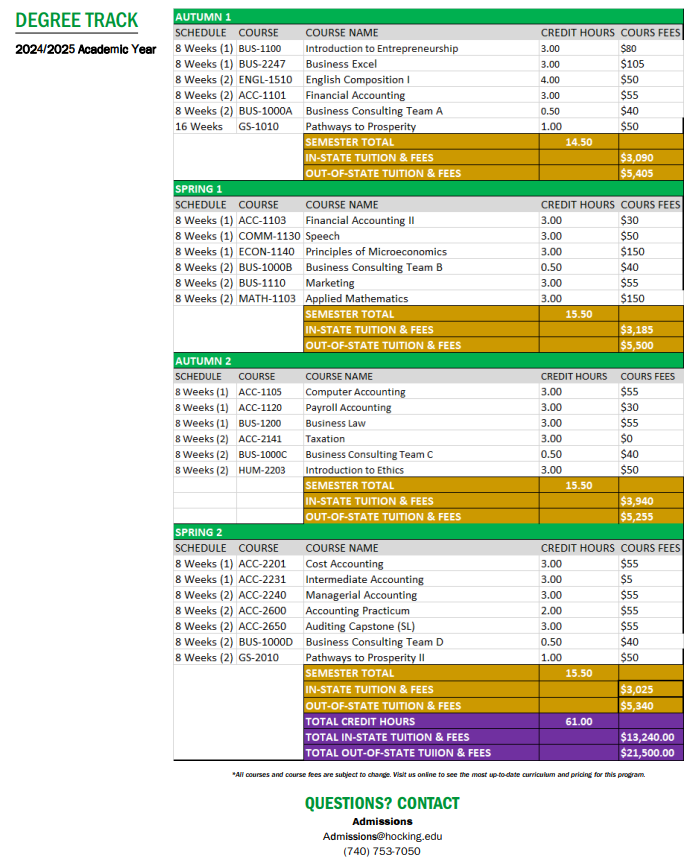

Hocking College offers all-inclusive pricing and works with students to assure they have complete college funding, including financial aid, before they start classes. Please reference the course curriculum tab for program costs.

All-inclusive pricing includes the following:

PER SEMESTER

$300......Learning Fee

$20........Health Center Services

$75........Career Center Services

Not included in the All-Inclusive pricing

$53......Parking

Pricing for housing and meal plans can be found here.

A Career in Accounting Delivers a Future of Financial Success

The demand for accountants and auditors has grown faster than average and U.S. News and World Report’s 2014 Best Jobs Issue ranked accounting as third best career.

The unemployment rate in the accounting field is half the national average and the growth rate is 13%, expected for the next ten years, according to the U.S. Bureau of Labor Statistics’ most recent report.

The following outcomes are skills, behaviors and attitudes cultivated in students seeking the Associate of Applied Business in Accounting and Financial Services:

- How to analyze and record business transactions

- How to prepare worksheets

- How to prepare and analyze financial statements

- How to provide financial information for stakeholders

- How to calculate and prepare a payroll

- How to prepare individual, partnership and corporate federal income tax returns

- How to apply auditing concepts to evaluate the effectiveness and efficiency of accounting processes

- How to utilize accounting software to record, analyze, and report financial data

Student Learning Outcomes (SLOs) are statements of what a student will be able to do when they have completed a program. They represent the knowledge and skills a program has determined are most important for students to gain from that program and include both the Success Skills (institutional outcomes) and Program Outcomes. SLOs are specific and measurable so the program can accurately assess the degree to which students have achieved each outcome, and they align with college and institution mission and values. Data on the achievement of SLOs is used to make improvements in the program and increase student success.

Hocking College Institutional Learning Outcomes

1) Demonstrate sound critical thinking, information literacy and technological competency in the production of academic writing and presentations

2) Apply the methods of mathematical, statistical or analytical reasoning to critically evaluate data, solve problems and effectively communicate findings.

3) Demonstrate an awareness of the social, political and economic forces which shape individuals, institutions and communities in the modern world.

4)Understand social justice and the diversities and complexities of the cultural and social world past and present and come to an informed sense of self and others.

5)Demonstrate a foundation of knowledge in the natural sciences based on theory and laboratory skills.

6) Cultivate ethical values, personal wellness and personal learning strategies in the development of the whole person, mind, body and spirit.

7) Integrate content material to application in the workforce and apply discipline specific knowledge and skills to successfully transfer or effectively meet the expectations of internships, workplace, volunteerism and/or entrepreneurship endeavors.

8) Utilize the ethical and professional application of current information technology and tools effectively.

Program Outcomes

The following outcomes are skills, behaviors and attitudes cultivated in students seeking the Associate of Applied Business in Accounting and Financial Services:

- Analyze and record business transactions in appropriate journals and ledgers, preparation of trial balance and worksheets with adjustments and the closing process including reversing entries.

- Prepare and analyze financial statements and other supporting accounting documents to provide stakeholders with usable financial information for decision making.

- Calculate and prepare payroll including all federal and state mandated payroll reports and accounting records.

- Utilize the Cost Accounting cycle and the concepts of perpetual and periodic inventory methods, and standard costing to determine manufacturing costs, produce manufacturing specific financial statements, and aid in managerial accounting decision making.

- Prepare individual, partnership, and corporate federal income tax returns including common types of income, adjustments, deductions, credits and additional taxes.

- Perform necessary accounting tasks for Non-Profit and Governmental entities employing the concepts of encumbrances, budgets and fund balance and the preparation of industry specific financial statements.

- Apply Auditing concepts including internal control, risk, audit trail, sampling, tests of controls and substantive tests, and auditor’s opinions to evaluate the effectiveness and efficiency of accounting processes.

- Utilize current accounting software to record, analyze, and report financial data.

Retention Rates

- All registered fall/autumn students with registration status for the following fall/autumn.

- Excludes special populations - College Credit Plus, Non Degree, Online Military and University Center.

Potential for upcoming fall/autumn excludes graduates from that fall/autumn, spring and summer terms.

| Academic Year | Retention Rate |

| 2014 | 58% |

| 2015 | 60% |

| 2016 | 65% |

| 2017 |

39% |

| 2018 | 33% |

Graduation Rates

Graduation rates are determined by the office of Institutional Research. To ensure appropriate time for data collection, this report will be run and posted annually in the last week of September for the previous academic year. It should be noted that annual graduation rates may change as students continue to graduate. The following criteria will be utilized for the calculation of graduation rates:

- Overall Program Completion Rate is defined as a percentage of the ratio:

All graduates of the program

__________________________________________

All students with the program in their history of programs of study - For the purposes of reporting, the program completion rates are aggregated by academic year of entry.

- A student is considered to have completed or graduated from a program or certificate by virtue of having been awarded the degree or certificate.

- A student is considered to be undertaking activity in a program of study for the duration of time that they are in an active status in a program or certificate. This is defined by having a Program of Study with a status of ‘A’ during the duration of time they are taking coursework. Should a student move in and out of active status in a program of study while continuing to take coursework, we only take into account the student’s activity while the program has an active status for that particular program of study.

| Academic Year | Graduation Rate |

| 2014 | 50% |

| 2015 | 47% |

| 2016 | 45% |

| 2017 | 33% |

| 2018 | 13% |